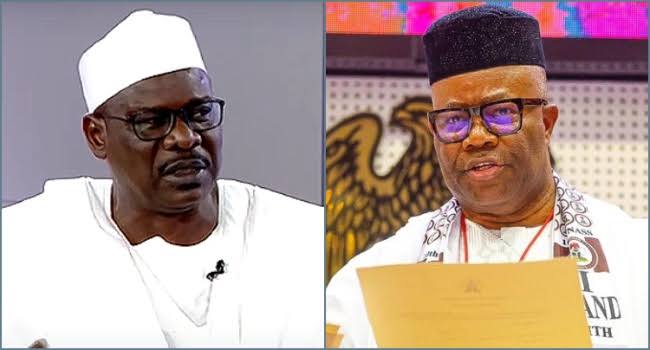

Borno South senator, Ali Ndume, has stated his opposition to the tax reform bills.

Tinubu’s proposed legislation aims to overhaul the country’s tax collection and administration systems, presenting an opportunity to create a more equitable and efficient taxation model.

At the heart of the bill are transformative provisions, such as revisions to the Value Added Tax (VAT) revenue-sharing formula and exemptions for small businesses and the average Nigerians. While these changes could potentially revitalize Nigeria’s economy, they also expose critical issues within the country’s federal structure, particularly the economic imbalances among regions (States and Local Governments

According to Ndume, the North is an asset and not a liability to Nigeria.

Ndume criticized the timing and scope of the bills, saying that they disproportionately target low- and middle-income Nigerians who are already suffering from President Bola Tinubu administration’s economic policies.

According to him, the North will never be a parasite or dependent on any region or even the country.

He explained, “As it is, the law is against all low- and middle-income Nigerians.”

Ndume called for the withdrawal of the tax reform bills, stressing the need for broader consultations and greater stakeholder involvement and advised the Federal Inland Revenue Service, FIRS, to focus on expanding the tax net and improving accountability and transparency.

He opined, “The FIRS should concentrate on expanding the tax net and collecting more. Also, accountability and transparency should be increased.”

Ndume urged the Central Bank of Nigeria, CBN, to scrutinize commercial banks, saying their substantial yearly profits warrant higher tax contributions.

The senator explained that the personnel and overhead expenditure for 2024 is about 50 to 60 percent of the budget itself, lamenting that in November, 20 percent of the budget has not been implemented as the recurrent expenditure has already been exhausted.

He alleged that over 15 to 20 trillion naira is going into personnel, debt servicing and recurrent expenditure.